Would Indian millionaire Vignesh Sundaresan be crazy enough to buy Beeple’s 5,000 digital image collage for $69 million? How would a crypto-art collector benefit from owning virtual objects? The answers are in these few lines.

Tokenization

First, it should be said that we are gradually witnessing the tokenization of our digital life, a phenomenon boosted by the rise of tokens or non-fungible tokens (NFT). The rise of cryptocurrencies, supported by the blockchain revolution, certainly has something to do with it. What is certain is that the traceability of an NFT and the certification of the identity of its owner complete the picture.

Exclusivity

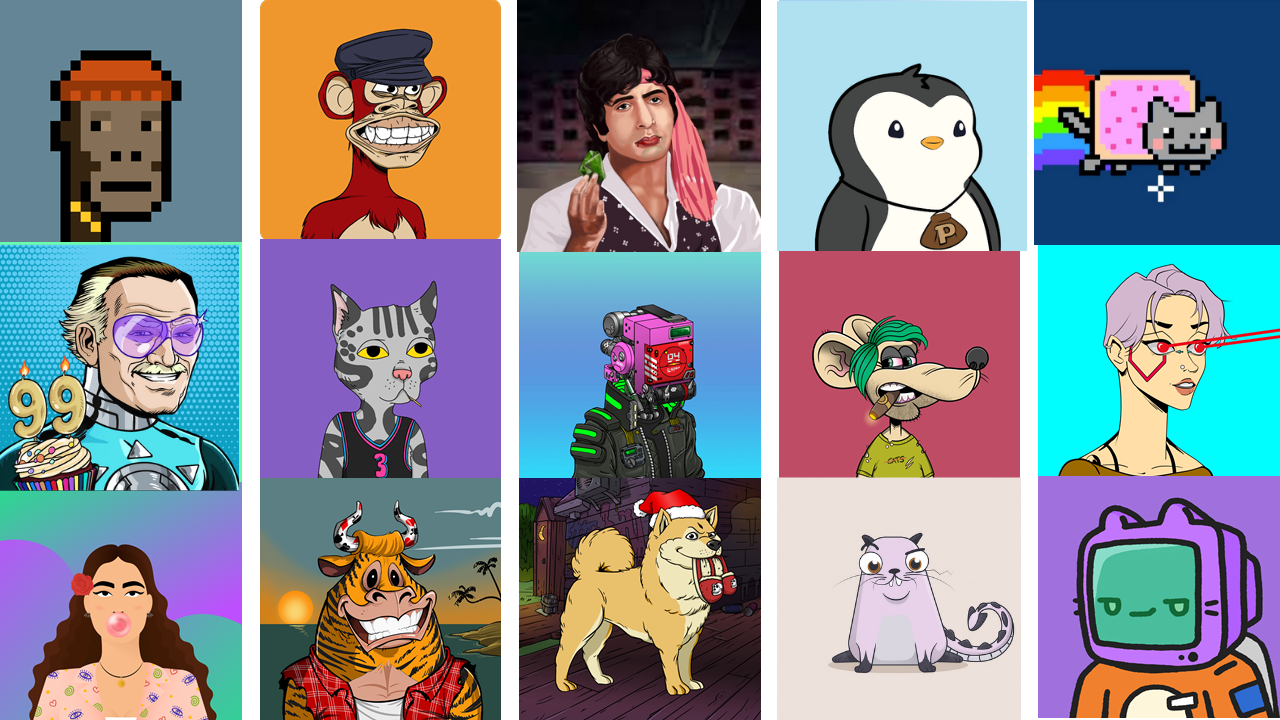

Thus, the ownership of a digital art object could only be understood by the physical art lovers themselves. The happy owner of a physical copy of an original work of art would certainly have as motivation the exclusive possession of the article in question and the possibility of resale in the future. Note, however, that this exclusivity does not exclude possible membership in a community, as is the case for holders of pixelated avatars of the CryptoPunks type.

Optimistic buying

Here, you don’t need to adopt the same reasoning of stock market investors, which requires a consensus of opinion to establish the value of an asset. With NFTs and physical art objects, market values take their roots from the motivation of the most optimistic buyer. Simply put, we’ll simply say that the awarding of any item will be based on the highest bid.

Resale

The idea of being able to resell the NFTs also influences the fluctuation of the price of a piece of crypto-art. Don’t worry if the price of a digital art object bought at $1 million in 2021 is sold for a double in 2022. It makes perfect sense in this universe.

Miscellaneous services and benefits

It’s not said often enough, but NFTs grant a whole host of perks like access to a new collection of digital assets. Moreover, they are not limited to art: see for yourself the concept of fan tokens developed by Socios for sports fans.

Do not forget the existence of detractors of NFT art who constantly evoke a “hype” in its favour. No matter what they say, don’t forget that the word “NFT” was voted word of the year by Collins. History to prove that we do not denigrate non-fungible tokens so easily.

Source: Quora.

You haven’t provided a single tangible advantage. It’s all speculative.

The one benefit of NFTs has nothing to do with a speculative bubble in overvalued digital assets of no use, but with the potential purchasing of real world goods and property, such as real estate, hassle free, devoid of the need for brokerages, and in a much more efficient manner. That is where their potentoal advantage lies.

Everything else are tulips soon to implode.