The evolution of means of exchange occurs continuously as society develops. If earlier, in order to buy yourself a meal, you had to go into the forest and get something edible, today it is sometimes enough to reach out with a watch to the terminal.

Moreover, this development process seems quite natural. From commodity money, humanity moved on to its equivalent in the form of various metal alloys, and later to paper banknotes and tickets. Every year, buying goods is becoming more and more convenient: today, all your finances can be safely placed on a piece of plastic smaller than a playing card. In this regard, the further transition of all cash to digital form seems natural. This will help to carry out our usual manipulations with money much faster and easier and expand the range of conveniences associated with them.

Today, cryptocurrencies are the closest to the currency of the future, they are called digital gold and new money. They are fast, convenient and protected from inflation since each type has an initial release limit. In addition, all transactions are carried out completely anonymously, and all your cryptocurrency is protected from counterfeiting thanks to the protection of a unique code.

But despite these conversations, no one buys bread in the supermarket for bitcoins. Let’s figure out why cryptocurrencies have not yet become a universal means of payment and whether this will happen in the future.

What are cryptocurrencies and how do they work?

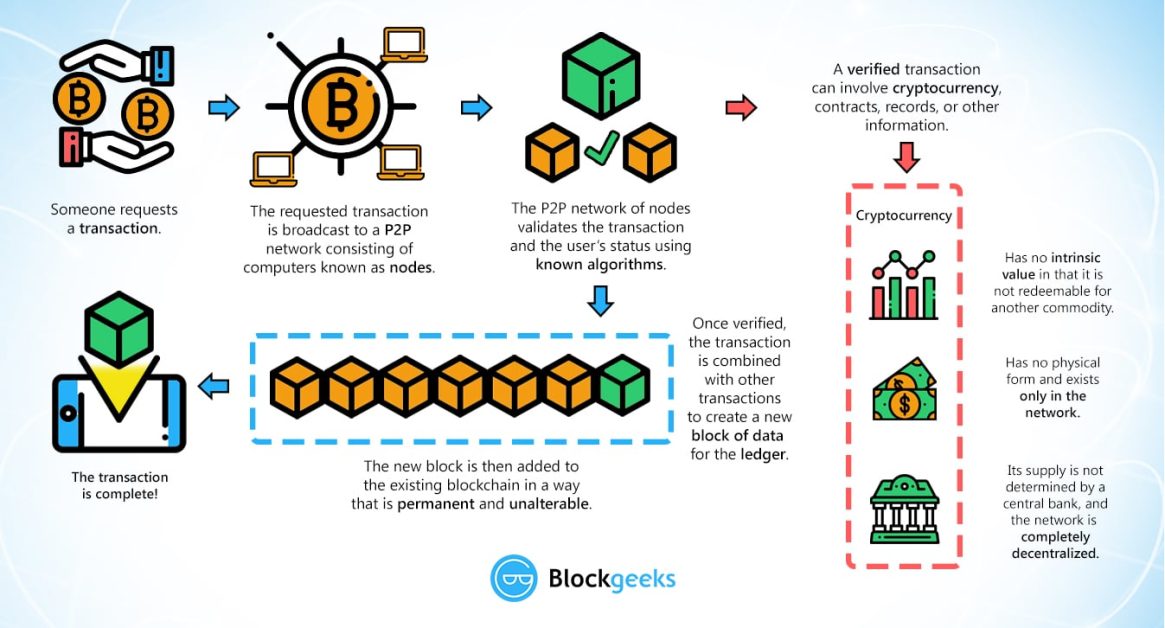

Cryptocurrency is a digital currency that does not have a single control centre, all participants have equal rights. The system is controlled by a mathematical code – no one can give the order to print “extra coins” or withdraw them from circulation.

Cryptocurrencies are a bit like non-cash money on a card or electronic wallet. Information that the user has a certain amount is recorded in a special register, a person can use this money without having to physically hold it in their hands. When transferring money, it is debited from their account and credited to the recipient’s account.

The difference is that for regular transfers there are intermediaries – banks, and payment providers – who record this information in their centralized registry and, under certain circumstances, can cancel the transaction or block the account.

In cryptocurrency networks, transactions are made directly and recorded in a decentralized registry – a blockchain. Information about all transactions in the blockchain is stored not in one place, but on all devices connected to this network. Any user can view information about any transaction from the moment the network is launched, but if the system has already accepted the payment, no one can cancel it or change the transaction chain.

In this system, each user is his own bank. Here, neither the state nor corporations have the exclusive right to issue or access user accounts: funds cannot be withdrawn without private keys. It is impossible to block transactions of a specific user because the system does not provide for any blacklists. Theoretically, the principle of decentralization assumes an increase in user trust in digital assets

When talking about cryptocurrencies in this article, we will use Bitcoin (BTC), launched in 2009, as an example. Although there are several thousand cryptocurrencies in the world today, Bitcoin’s share of this market as the time of writing this post is 55.99%. The share of other cryptocurrencies is so small that their chances of overtaking Bitcoin as a universal means of payment are minimal.

Why Cryptocurrencies Haven’t Become the Standard Means of Payment Yet

The Bitcoin network currently processes an average of 504,062 transactions per day, but these are mostly not purchases, but rather the transfer of cryptocurrency from one owner to another. These are more like stock market games – people sell and buy Bitcoin to make money on exchange rate fluctuations.

There are several disadvantages that prevent cryptocurrencies from being used as regular money.

- Inability to contact support and cancel the transaction: The banking system can return an erroneous transfer, but if you send bitcoins to the wrong recipient, you lose them. The same thing happens if you forget, lose, or have your private wallet key stolen.

- Instability of the digital coin rate: Imagine that today you paid $100 for groceries in a supermarket, tomorrow – $140, and the day after tomorrow – $70. With classic money this only happens during a default, but with cryptocurrencies – regularly. It is very difficult to perceive an asset as a payment instrument that can grow or fall by 30-40% in a day.

- Low scalability: Visa handles 65,000 transactions per second, Bitcoin – no more than seven. The problem is currently being solved using the Lightning Network protocol. This is an add-on to the Bitcoin blockchain, where users can make payments without loading the blockchain – only the final balance is recorded there. With the Lightning Network, it will be more convenient to pay for small purchases.

- Too low capitalization: Capitalization is the number of coins in circulation multiplied by the rate of each coin. It shows the specific weight of the asset on the scale of the global economy. As of August 3, 2024, the cryptocurrency market cap was $1.195 trillion. As of March 2024, there are just over 46 million Bitcoin wallets holding at least $1 of value. Bitcoin’s capitalization on August 4, 2024, was 1.20 trillion dollars. This is a lot for an asset that was worth nothing 15 years ago, but very little (less than 1%) compared to all the money in the world.

The total money supply is estimated at up to $75 trillion, with gold capitalization at around $10 trillion. For cryptocurrencies to seriously compete with fiat or at least gold, their capitalization must grow significantly.

The growth of Bitcoin capitalization is possible only due to a strong growth of the rate since the number of Bitcoins themselves is limited. They cannot be made as many as needed for capitalization growth – the code states that there can only be 21 million coins. Currently, 19 million have already been mined and are in circulation.

Let’s assume that Bitcoin will one day be worth a million dollars. Provided that all the coins are mined by that time, its capitalization will be $21 trillion – twice as much as the capitalization of gold. In this case, the cryptocurrency will have a sufficient share in the global economy to compete with fiat. But so far, this is far away.

- Low capitalization has another disadvantage: the market is volatile and depends on the actions of large players. There are several dozen wallets containing tens of thousands of bitcoins. The owners of these wallets (the so-called “whales”, that is, large holders) can influence the rate, if they put their bitcoins up for sale, the rate will collapse.

- There is no security other than the trust of users: This means that the price can fall to zero if people suddenly lose trust in cryptocurrencies.

In the first months after the appearance of Bitcoin, its very existence was in question – if no one was interested in it, the project would have come to nothing. Now, an entire infrastructure has been built for Bitcoin owners. Derivatives (futures, options) on Bitcoin are traded on the traditional financial market. But there is still no such trust as in classic money backed by the state.

- Use for Illegal Transactions: Europol’s annual Internet Organized Threat Assessment (IOCTA) report confirms that BTC remains the most widely used cryptocurrency by criminals.

According to the report of the Center for International Security and Defense Policy of the American corporation RAND “Terrorist Use of Cryptocurrency: Technical and Organizational Complexities and Future Threats”, cryptocurrencies in their current form do not pose a global threat as a tool for financing global terrorism, but the emergence of a new anonymous cryptocurrency that is better suited for these purposes cannot be ruled out. Therefore, the cryptocurrency industry needs regulation.

- Bitcoin mining requires a lot of electricity: which poses a threat to the environment. According to the Centre for Alternative Finance at Cambridge, the Bitcoin network consumes 69.98 TWh (terawatt-hours) per year – more than Austria or Columbia. According to the Nature Climate Change study, in 20 years, mining could raise the Earth’s temperature by 2°C, which will lead to irreversible consequences. Today, mining emits 22 megatons of carbon dioxide into the atmosphere every year – more than Jordan, Sri Lanka and Kansas City combined.

According to other studies, the actual volume of carbon dioxide emissions into the atmosphere is less – 17.2 megatons.

- The legal status of cryptocurrencies is not defined in most countries: Owners of digital assets are at risk and their investments may be completely banned at the legislative level.

While regulators around the world are trying to develop a unified approach to this issue, in July 2018, the European Commission’s fifth Anti-Money Laundering (AML) Directive on cryptocurrency regulation was issued, with new standards for ensuring transaction transparency. EU member states must implement these rules in their national laws no later than January 20, 2020.

In Japan and some other countries, Bitcoin is recognized as a means of payment, but in most countries, it is considered an asset. Cryptocurrency can participate in barter transactions, there have already been precedents of inclusion in the authorized capital of an enterprise and payment of alimony with Bitcoin. However, the final legal status of cryptocurrencies in the world has not yet been determined.

Regulators’ initiatives indicate that they do not plan to ban cryptocurrencies, but they want to reduce user anonymity to zero and make payments as transparent as possible for tax and law enforcement agencies.

- Cryptocurrency networks can be hacked (for example, by taking control of the majority of mining pools): In theory, people with huge computing power can take control of the network, start creating alternative chains and confirm transactions that are beneficial to them. To do this, you need to carry out a so-called “51% attack“.

But cryptocurrency networks are resistant to hacking, and the larger the network, the more resilient it is. In addition, the blocks in the blockchain are linked using cryptographic proofs. The longer the chain of blocks in the blockchain, the more difficult it becomes to change previously confirmed blocks. Even a successful attack will likely only be able to change the transactions of a few recent blocks for a short period of time.

For the Bitcoin network, the cost of such an attack would be higher than the benefit of its implementation. To hack the Bitcoin network today, you need a lot of power and a lot of money. If some organization manages to do it, it will still not gain access to all the mined bitcoins. The benefits gained – the ability to confirm the necessary transactions and create new chains – will not cover the costs of a 51% attack. Even if the network is disrupted, the community will be able to quickly agree on changing the software and the Bitcoin protocol in response to this attack.

What are the chances of cryptocurrencies replacing money?

In order to become a major payment instrument in the future, a cryptocurrency must meet at least three basic monetary requirements. Bitcoin must act as a store of value, a fully-fledged medium of exchange, and a unit of account.

Today, cryptocurrency only fully meets the first criterion but has significant potential to possess all three necessary properties. In the context of digital money, compliance with these requirements can be assessed based on the cryptocurrency’s ability to cope with five main tasks: scalability, ease of use, security, volatility, and privacy.

Technically, it is possible to buy goods for Bitcoin today. You can see a full list of retail outlets working with cryptocurrency on CoinMap. There are examples of large transactions for bitcoins – for example, with real estate. There are cards (Wirex, CryptoPay, BitPay, Xapo and others) that allow you to quickly convert cryptocurrency into fiat and pay at any point where Visa or MasterCard is accepted.

The main obstacle to Bitcoin becoming a full-fledged means of payment is its high volatility, i.e. frequent and sharp fluctuations in value. Most cryptocurrency owners today perceive digital assets as speculative instruments. They prefer to hold them or trade them in the hope of making money, instead of spending them on goods and services.

Every year, new cryptocurrencies and new ways of using them appear. Despite the cautious attitude towards Bitcoin on the part of state authorities, some governments are exploring options for creating their own cryptocurrencies. There are already cases with national cryptocurrencies (for example, Venezuela’s El Petro). China has already developed its national cryptocurrency – digital RMB.

Cases with national cryptocurrencies show that states are interested in blockchain technology, but do not like the idea of decentralized issuance of financial assets. National cryptocurrencies are essentially stablecoins — digital coins on the blockchain, backed by national currency, gold, oil or other assets. Their issuance and emission are controlled by the state. But it is still difficult to say what place centralized state cryptocurrencies will take in the global financial system, and whether they will be able to displace Bitcoin.

The debate about which currency will become the main means of payment has been going on for a long time, and the opinions of experts and analysts are often contradictory:

- Co-founder and former CEO of crypto exchange BTCC Bobby Lee believes that in 4 years Bitcoin will cost $500,000 and will surpass gold in capitalization.

- US Federal Reserve Chairman Jerome Powell admitted at a hearing of the US Senate Banking Committee in the summer of 2019 that there is a chance that a global cryptocurrency could change the global financial system, but this is theoretically possible only if cryptocurrencies are widely adopted.

- The world’s richest investor, Berkshire Hathaway CEO Warren Buffett, does not believe in Bitcoin and does not recommend investing in it.

- Microsoft founder Bill Gates called Bitcoin the most speculative thing in the world, and investing in it a pure Greater Fool Theory.

- The head of JP Morgan Chase said that the surge in popularity of cryptocurrencies is short-lived, and the sharp rise in their value can be compared to the rise in prices for tulip bulbs in the Netherlands in the 17th century.

- Economist Nouriel Roubini, financial expert Peter Schiff and many other analysts do not believe in cryptocurrencies.

Different experts and investors express completely different opinions about the prospects of cryptocurrency – from falling to zero to growth to $100,000-1,000,000.

At the moment, cryptocurrencies cannot displace fiat money as a means of payment. Of the three functions of money (measure of value, means of payment, and means of accumulation), Bitcoin today performs one well: it is used mainly as a means of accumulation and speculation.

But as the industry develops, the situation may change. After all, Bitcoin, thanks to its good divisibility (1 BTC includes 100,000,000 particles – satoshi) and the possibility of fast and cheap transfers, is convenient for settlements. It is also possible that in addition to Bitcoin, a new global cryptocurrency will appear in the future, which will be able to change the balance of power in the financial space.